http://www.thailand4.com/.prop/2019-01-22/8d9c9f71e97a77cc12a1c4a5fa22aece/

As the prices of new condominiums in downtown Bangkok have continued to rise, many buyers have begun considering resale, or second-hand, condominiums as an alternative to brand-new projects. CBRE, an international property consultant, has seen an increase in demand for the existing second-hand market from Q4 2018. As the prices of second-hand condominium units are often cheaper than those at newly-launched projects, buyers benefit from bigger unit sizes at more affordable prices.

There are two types of resale units; those in buildings under construction where investors want to resell before transfer of title and those in completed ready-to-move-in units where the title has already been transferred to the original buyer.

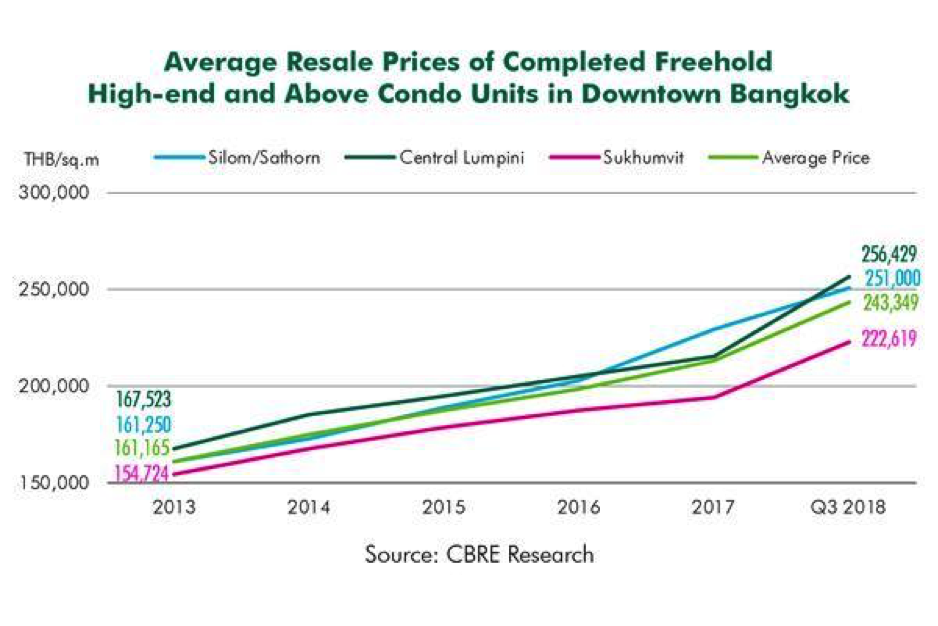

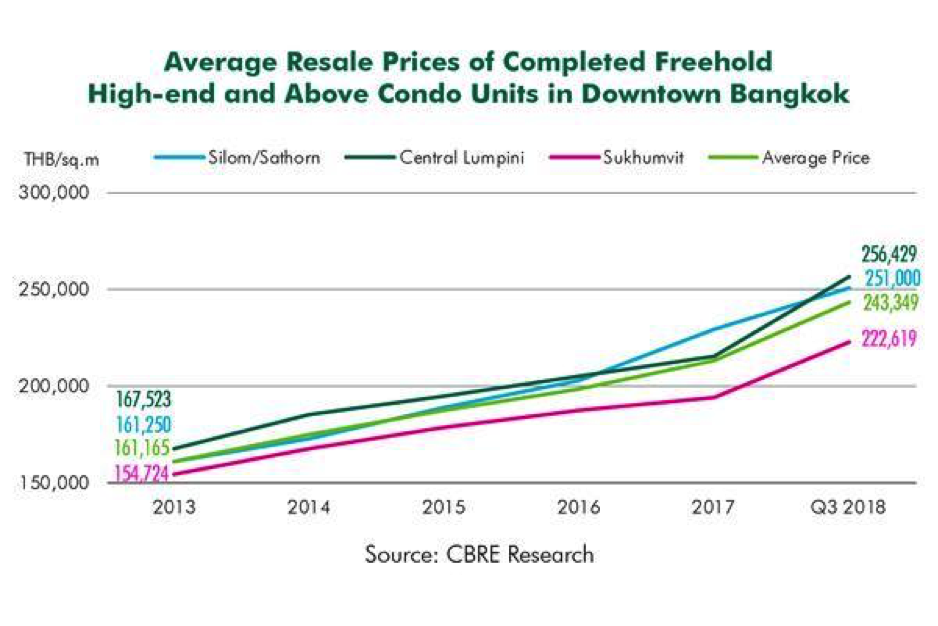

According to the survey by CBRE Research, the total supply of completed condominiums as of Q3 2018 in downtown Bangkok was 145,350 units, with prices ranging from THB 55,000 – 350,000 baht per sq.m., depending on the grade and age of the condominium, and how well the building has been maintained. The selling price of newly-launched condominiums in downtown Bangkok in the luxury grade now ranges from THB 300,000 – 600,000 per sq.m., which generally have smaller unit sizes than older completed buildings.

Ms. Pornpimol Phuengkhuankhan, Head of Advisory & Transaction – Residential Sales Ad Hoc, CBRE Thailand said the market for resale-before-completion units is more active right after launch if the project sells out and there are no units left for sale by the developer. During construction, uncompleted units’ resale activity tends to drop and picks up again as the project nears completion.

In terms of payment, purchasers pay the seller the amount that has already been paid to the developer together plus the seller’s profit. The original sales and purchase contract is then assigned to the new buyer who takes all responsibility for any future payments to the developer. For most high-end properties in the central business district (CBD), the payment terms offered by developers are 10% on signing a sales and purchase contract, and 10-20% during the construction period with the balance paid on transfer of title at the completion of construction. The amount that the new purchaser must still pay to the developer depends on how many monthly down payments remain before transfer of title. It is important to note that the developer must sign the assignment agreement as well as the seller and purchaser for the contract transfer to be valid.

The key considerations for the purchaser are the reputation of the developer and the track record of their ability to deliver the quality described in the sales material.

For a completed building, the sale process includes signing a standard sales and purchase contract, usually with a deposit equivalent to ten per cent of the price, and transfer of title at the Land Department 30-60 days after signing the sale and purchase agreement. The balance of the price is payable to the seller at the Land Department on transfer of title.

The key considerations for purchasers of units in an older building are how good the original construction quality was, how well the building has been maintained, and the current financial status of the condominium juristic office, an entity jointly contracted by all co-owners that manages the common areas of the property as well as provides building maintenance.

Since the passing of the original Condominium Act in 1979, most Thai buyers have preferred new buildings, buying units off plan from a developer or a resale unit from an investor just before completion, rather than buying second-hand completed properties.

“However, since the price difference between new launches and older, completed properties is now becoming so great that buyers who want a unit to live in are looking increasingly at existing developments as new developments are priced beyond most Thai buyers’ budgets. Buyers are increasingly willing to give up the prejudice against previously occupied condominium units in return for the ability to buy a larger unit for their money,” added Ms. Pornpimol.

There is a wide range of quality among existing developments with some old projects being as good as new properties while others were poorly built originally and/or have been poorly maintained. Buyers looking at existing buildings should do due diligence on the construction quality and condition of maintenance as well as gain understanding of the financial situation of the juristic office of the building in order to gain an insight into the probability that the building will be well maintained and appreciate in value in the future.